画像をダウンロード bond yield to maturity calculator online 149494-Bond yield to maturity calculator online

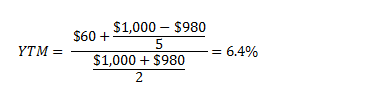

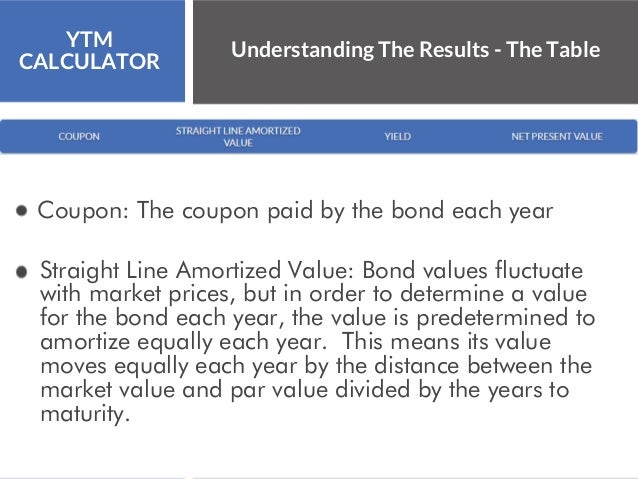

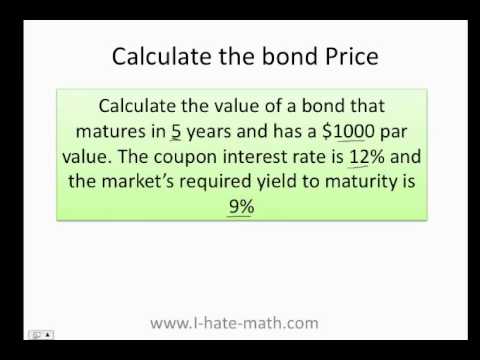

The Bond Yield to Maturity Calculator is used to calculate the bond yield to maturity Bond Yield to Maturity Definition The bond yield to maturity (abbreviated as Bond YTM) is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity and that all couponThis free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon ratesConsider the issue price of Bond at $ 90, and redemption value be $ 105 Calculate the posttax Yield to Maturity for the investor where the rate of normal Income tax can be assumed at 30% and capital gains are taxed at 10% You are required to calculate posttax yield to maturity

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond yield to maturity calculator online

Bond yield to maturity calculator online-With links to articles for more informationThis financial calculator approximates the selling price of a bond by considering these variables that should be provided Face/par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreed

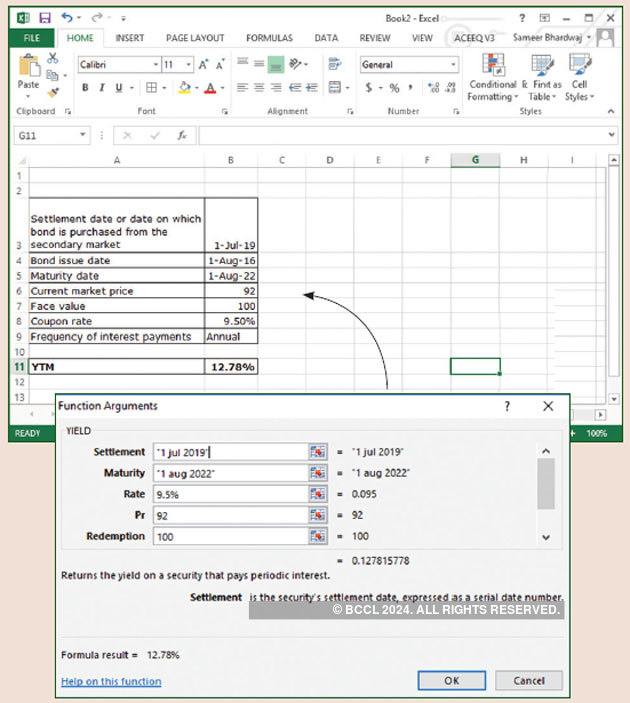

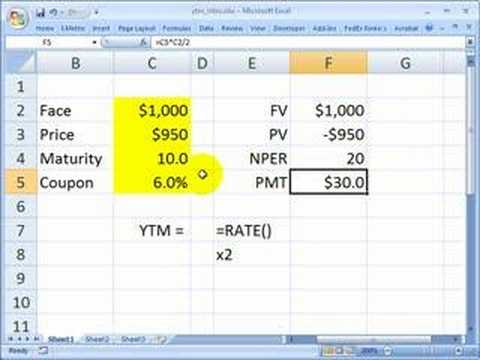

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

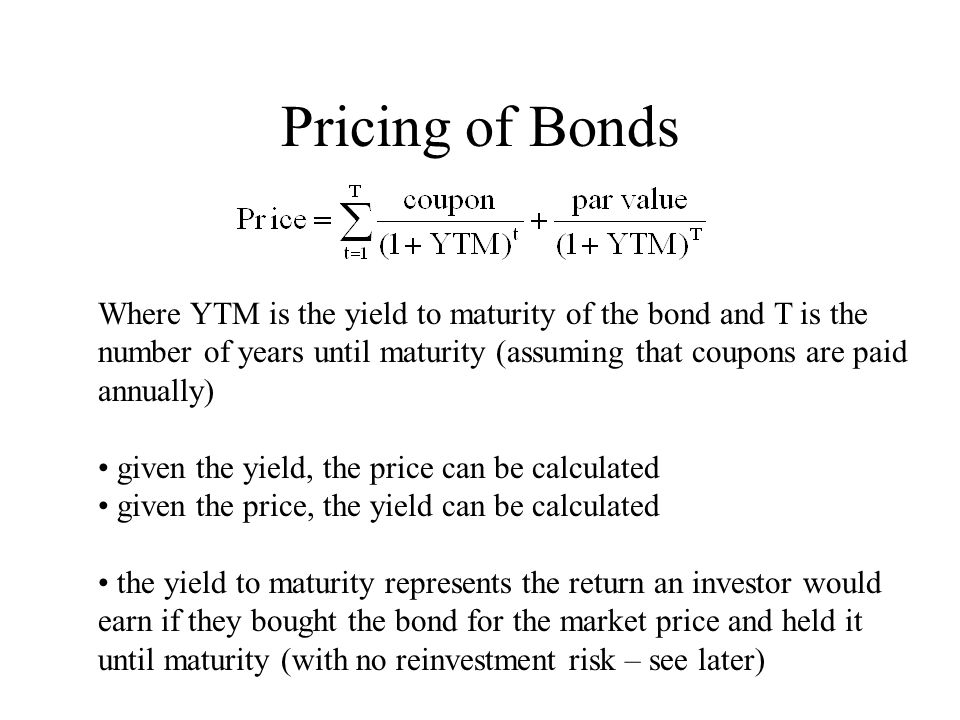

Yield to Maturity (YTM), also known as book yield or redemption yield, of a bond or other fixedinterest security The yield to maturity (IRR) is nothing but the interest rate earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity and that all coupon and principal payments are made on scheduleFuture Value (Compound Interest) EMI Calculator;You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the results

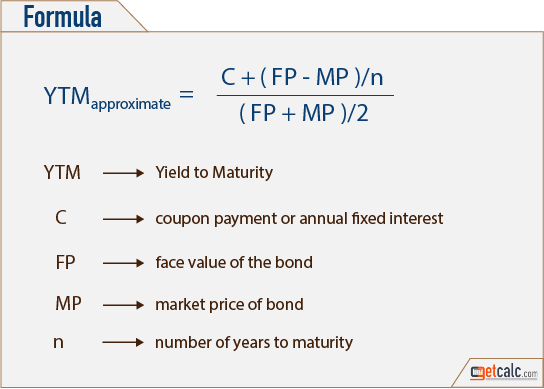

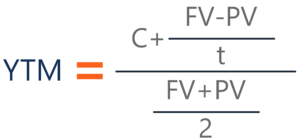

Years to maturity (N) The algorithm behind this yield to maturity calculator applies this formula ~ Yield To Maturity (YTM) = (ACP (BFV CCP) / N) / ((BFV CCP) / 2) Understanding the concept of the yield of maturity In finance theory, the YTM represents the rate of return forecasted on a bond if held until its maturityTo calculate the price for a given yield to maturity see the Bond Price Calculator Face Value This is the nominal value of debt that the bond represents It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption dateThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturity

Future Value (Compound Interest) EMI Calculator;How to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturityMost of the online stores are offering coupon codes, and Zero Coupon Bond Yield To Maturity Calculator is one of them It comes with various coupon codes options You can simply look for the coupon code of your respective store

Yield To Worst What It Is And Why It S Important

Yield To Maturity Formula Step By Step Calculation With Examples

Investor Education Financial Education SCORES Trainers Portal Investor Assistance Bond Yield Current Price Par Value Coupon Rate % Years to Maturity Calculate Current Yield % Yield to Maturity %Find out what your paper savings bonds are worth with our online Calculator The Calculator will price paper bonds of these series EE, E, I, and savings notes Other features include current interest rate, next accrual date, final maturity date, and yeartodate interest earnedFind out what your paper savings bonds are worth with our online Calculator The Calculator will price paper bonds of these series EE, E, I, and savings notes Other features include current interest rate, next accrual date, final maturity date, and yeartodate interest earned

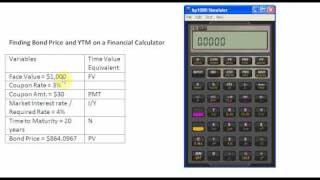

Finding Bond Price And Ytm On A Financial Calculator Youtube

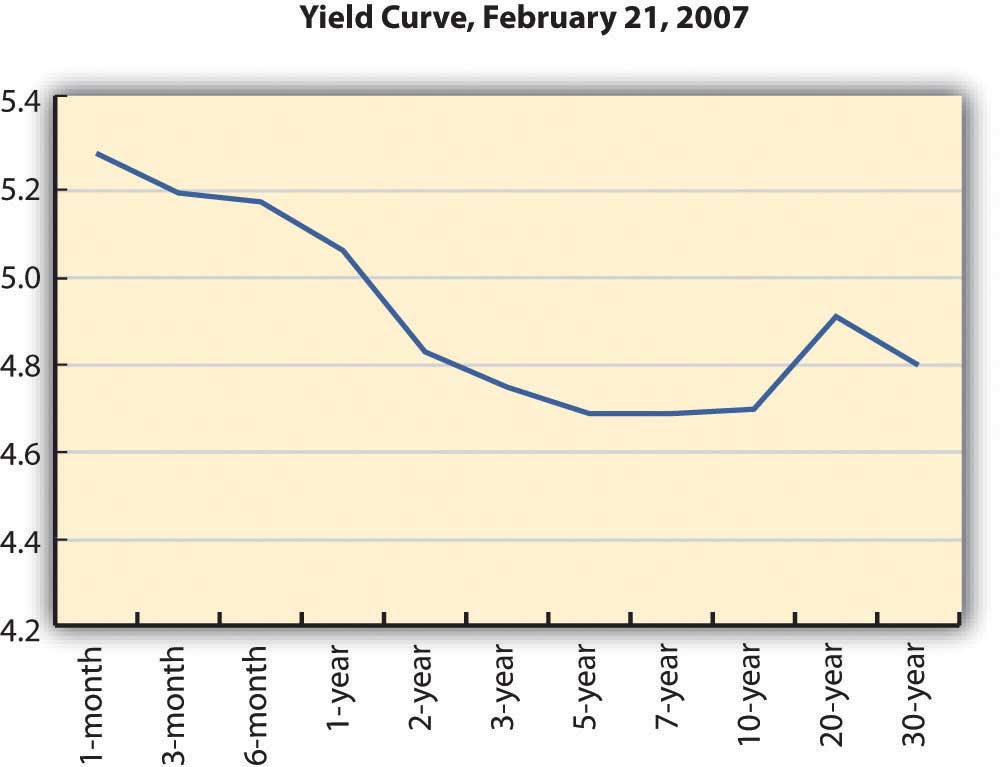

Yield Curve Definition Example Investinganswers

Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield = Bond Par Value*(Coupon Rate) / Current Bond Price Bond Equivalent Yield Calculator Zero Coupon Bond Calculator Yield to Maturity Calculator Effective Yield Calculator Dividend Yield Calculator Electrical Calculators Real Estate CalculatorsHow to save money in online shopping on Zero Coupon Bond Yield To Maturity Calculator?Bond YTM Calculator Bond yield calculator to calculate Yield To Maturity (YTM) of a coupon paying bond This calculator also calculates accrued interest, dirty price, settlement amount and Bond Duration Bond cash flows are also generated To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator Bond Details

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Yield To Maturity Calculator Ytm Calculator

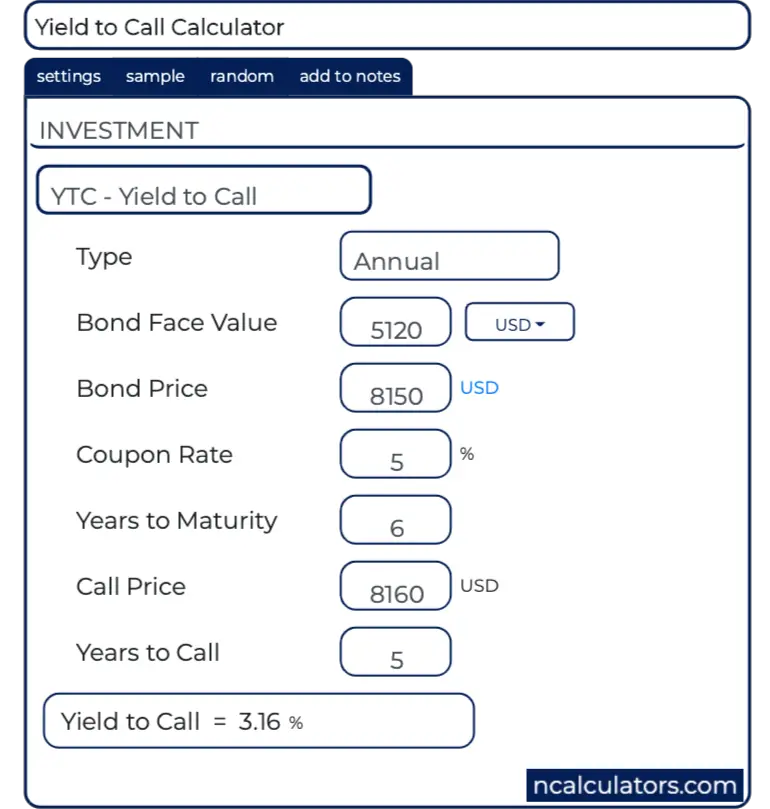

Bond YTM Calculator Bond yield calculator to calculate Yield To Maturity (YTM) of a coupon paying bond This calculator also calculates accrued interest, dirty price, settlement amount and Bond Duration Bond cash flows are also generated To calculate YTM on zero coupon bond, use Zero Coupon Bond Yield Calculator Bond DetailsCurrent yield is the bond's coupon yield divided by its market price A bond return calculator will allow you to calculate yield to maturity (YTM) and yield to call (YTC) which takes into account the impact on a bond's yield if it is called prior to maturity The yield to worst (YTW) will be the lowest of the YTM and YTC It is the mostYield to Maturity (YTM), also known as book yield or redemption yield, of a bond or other fixedinterest security The yield to maturity (IRR) is nothing but the interest rate earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity and that all coupon and principal payments are made on schedule

Understanding Bond Prices And Yields

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

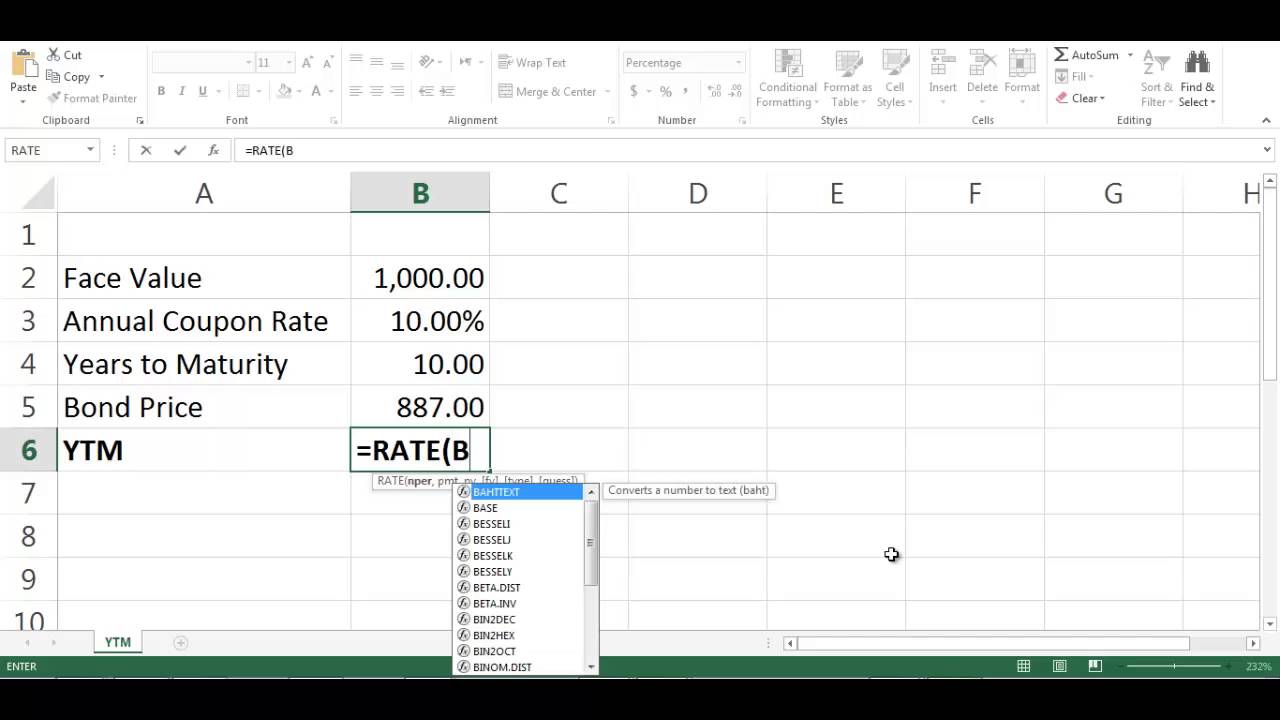

This yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityYou will want a higher price for your bond so that yield to maturity from your bond will be 45% Let's calculate now your bond price with the same Excel PV function =PV (450%/4, 4*10, 1500, 100,000) = $112, So, you will be able to sell your bond at $112, with a premium of amount $12, Working FileYield to Maturity (YTM), also known as book yield or redemption yield, of a bond or other fixedinterest security The yield to maturity (IRR) is nothing but the interest rate earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity and that all coupon and principal payments are made on schedule

P2tdoqhmnx Yjm

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Bond Calculator Instruction The Bond Calculator can be used to calculate Bond Price and to determine the YieldtoMaturity and YieldtoCall on Bonds Bond Price Field The Price of the bond is calculated or entered in this field Enter amount in negative valueTo calculate a bond's yield to call, enter the face value (also known as "par value"), the coupon rate, the number of years to the call date, the frequency of payments, the call premium (if any), and the current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and 8% coupon for $900That is why we calculate the yield to call (YTC) for callable bonds The yield to call is identical, in concept, to the yield to maturity, except that we assume that the bond will be called at the next call date, and we add the call premium to the face value Let's return to our example Assume that the bond may be called in one year with a

Ytm Yield To Maturity Calculator

How To Calculate Yield For A Callable Bond The Motley Fool

On this page is a bond duration calculatorIt will compute the mean bond duration measured in years (the Macaulay duration), and the bond's price sensitivity to interest rate changes (the modified duration) You can input either the market yield or yield to maturity, or the bond's price, and the tool will compute the associated durations Macaulay and Modified Bond Duration CalculatorInvestor Education Financial Education SCORES Trainers Portal Investor Assistance Bond Yield Current Price Par Value Coupon Rate % Years to Maturity Calculate Current Yield % Yield to Maturity %This free online Bond Yield to Maturity Calculator will calculate a bond's total annualized rate of return if held until its maturity date, given the current price, the par value, and the coupon rate Using this bond YTM calculator will help you to quickly compare the total return on bonds with different prices and coupon rates Also on this page

Zero Coupon Bond Yield Formula With Calculator

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Calculate Yield to Maturity (YTM) to Know the Profitability of Bond Investment Yield to maturity also known as book yield is calculated to estimate the rate of return on long term or a fixed rate security investments, however, it is expressed as an annual rate This method assumes that the bond is purchased at the market price and all theYield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingCalculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield Calculator

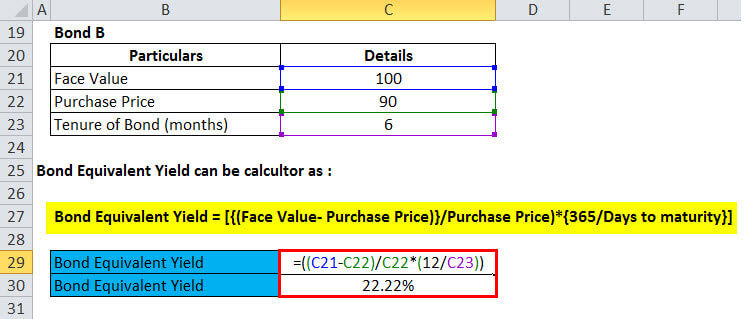

Bond Equivalent Yield Formula Calculator Excel Template

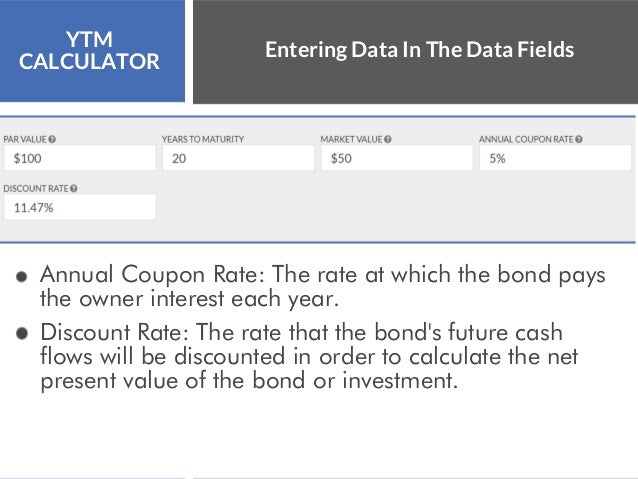

Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityCalculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yieldThe calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity Yield to Maturity (YTM) = (C (FP)/n)/ (FP)/2, where C = Bond Coupon Rate F = Bond Par Value

Bond Prices Rates And Yields

Bond Yield To Maturity Ytm Calculator Luxxprime

Bond Yield to Maturity Calculator is then used by using assumptions that the bond is going to be held up to its maturity, while all of the principal payments and coupons will be on schedule By using this calculator, the investors will be able to estimate how much benefit they can expect from the bonds they have already gotOn this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time The page also includes the approximate yield to maturity formula, and includes a discussion on how to find – or approach – the exact yield to maturityYield To Maturity (YTM) Calculator Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Just copy and paste the below code to your webpage where you want to display this calculator

Bond Convexity Calculator Estimate A Bond S Yield Sensitivity Dqydj

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Bond Yield to Maturity Calculator is then used by using assumptions that the bond is going to be held up to its maturity, while all of the principal payments and coupons will be on schedule By using this calculator, the investors will be able to estimate how much benefit they can expect from the bonds they have already got• Coupon Bond Calculate Bond Macaulay Duration, Modified Macaulay Duration, Convexity Enter the coupon, yield to maturity, maturity and par in order to calculate the Coupon Bond's Macaulay Duration, Modified Macaulay Duration and Convexity Press the "Calculate" button to calculate the values Example 1This calculator shows the current yield and yield to maturity on a bond;

Bond Yield Calculator Bond Yield To Maturity Calculator

Best Excel Tutorial How To Calculate Yield In Excel

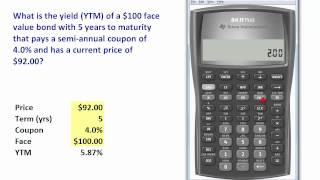

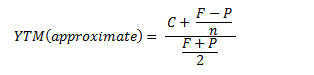

Yield to Maturity calculator uses Yield to Maturity (YTM)=(Coupon Payment((Face ValuePrice)/Years to Maturity))/((Face ValuePrice)/2) to calculate the Yield to Maturity (YTM), Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until the end of its lifetimeFree Online Textbook @ https//businessfinanceessentialspressbookscom/An example of calculating YieldtoMaturity using the 5key approachCalculators Calculators Bond Yield;

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Yield To Maturity 9 Steps With Pictures

YTM Calculator More about the YieldtoMaturity Calculator so you can better understand how to use this solver The \(YTM\) is the corresponding return that will equate the present value of all cash flows associated to a bond (coupon payments as well as the face value of the bond that is paid at maturity) Usually, unless we have a zerocoupon bond, the \(YTM\) cannot computed directly andYTM Calculator More about the YieldtoMaturity Calculator so you can better understand how to use this solver The \(YTM\) is the corresponding return that will equate the present value of all cash flows associated to a bond (coupon payments as well as the face value of the bond that is paid at maturity) Usually, unless we have a zerocoupon bond, the \(YTM\) cannot computed directly andOnline financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Code to add this calci to your website Just copy and paste the below code to your webpage where you want to display this calculator

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Learn To Calculate Yield To Maturity In Ms Excel

Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingYield to Maturity Calculator Good Calculators CODES (2 days ago) You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the resultsTo calculate the approximate yield to maturity, you need to know the coupon payment, the face value of the bond, the price paid for the bond and the number of years to maturity These figures are plugged into the formula Approx YTM =(C ((FP)/n))/(FP)/2

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Call Ytc Calculator

Calculators Calculators Bond Yield;Free Online Textbook @ https//businessfinanceessentialspressbookscom/An example of calculating YieldtoMaturity using the 5key approachYears to maturity (N) The algorithm behind this yield to maturity calculator applies this formula ~ Yield To Maturity (YTM) = (ACP (BFV CCP) / N) / ((BFV CCP) / 2) Understanding the concept of the yield of maturity In finance theory, the YTM represents the rate of return forecasted on a bond if held until its maturity

Bond Value

How Do You Enter In The Calculator Problem 6 4 Bond Yields Lo 2 The Petit Chef Homeworklib

Yield To Maturity Ytm Calculator

Finding Yield To Maturity Using Excel Youtube

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

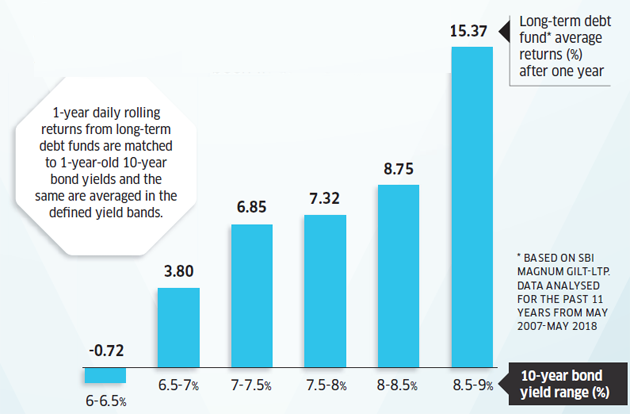

Bond Yields Savings How Rising Bond Yields Will Impact Your Savings

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Chapter 11 Bond Yields And Prices Ppt Video Online Download

Yield To Maturity Approximate Formula With Calculator

3 Valuing Bonds Ppt Video Online Download

Bond Price Calculator Present Value Of Future Cashflows Dqydj

How To Calculate Yield For A Callable Bond The Motley Fool

Bond Yield Calculator

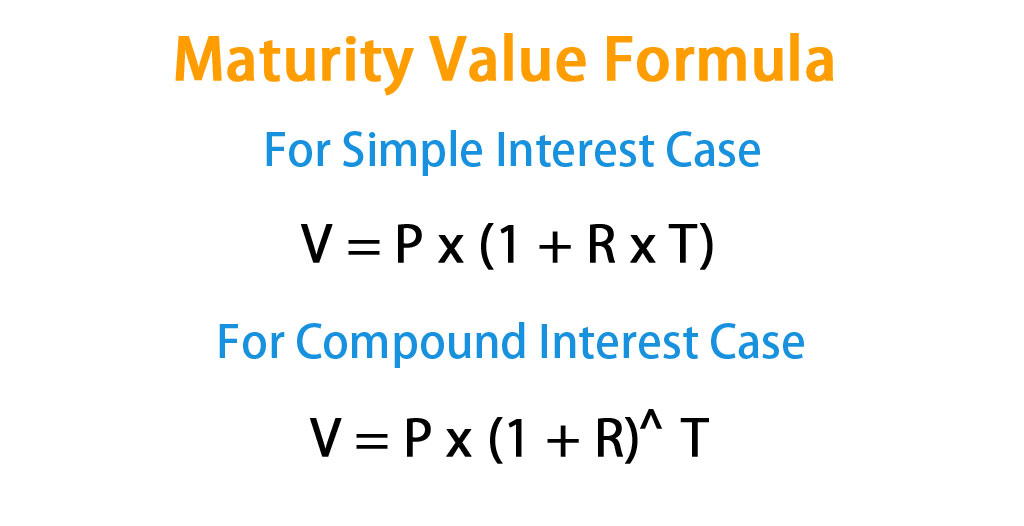

Maturity Value Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Calculator Ytm Calculator

What Is Yield To Maturity How To Calculate It Scripbox

Yield To Maturity Calculator Ytm Calculator

Yield To Maturity Ytm Calculator

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Pricing And Accrued Interest Illustrated With Examples

What Is Yield To Maturity How To Calculate It Scripbox

Bond Equivalent Yield Formula Calculator Excel Template

16 2 Bond Value Personal Finance

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Bond Yield And Return Finra Org

How To Calculate Bond Yield And Risk Finance Drops

Bond Yield Formula Calculator Example With Excel Template

Free Bond Valuation Yield To Maturity Spreadsheet

Vindeep Com Financial Calculators

Bond Yield To Maturity Ytm Calculator

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Calculating Bond S Yield To Maturity Using Excel Youtube

What Is Yield To Maturity How To Calculate It Scripbox

Bond Yield To Maturity Calculator For Comparing Bonds

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Calculate Yield To Maturity 9 Steps With Pictures

Fin 301 Hw 7 Chapter 9 Fin 301 Studocu

Finding Ytm By Using Financial Calculator Edit Youtube

Yield To Maturity Ytm Overview Formula And Importance

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Bond Yield Formula Calculator Example With Excel Template

Bond Yield To Maturity Ytm Calculator

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

How To Calculate Bond Yield And Risk Finance Drops

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Yield To Maturity Ytm Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Par Yield Curve Definition

Bonds Yields And Yield To Maturity Economics Online

Chapter 11 Bond Yields And Prices Ppt Video Online Download

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

A Bond Convexity Primer Cfa Institute Enterprising Investor

Excel Ytm Calculator Calculator Spreadsheet Free Download

Bond Pricing Formula How To Calculate Bond Price

Bond Yield Calculator

Yield Function Formula Examples Calculate Yield In Excel

Bond Yields Savings How Rising Bond Yields Will Impact Your Savings

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Learn To Calculate Yield To Maturity In Ms Excel

Owning Bonds

How To Calculate The Bond Price And Yield To Maturity Youtube

Q Tbn And9gctpp Yhakt6zldckkc4thylaemc1itl Zuuhu5g Pgc4 Aobhyf Usqp Cau

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Yield To Maturity Ytm Overview Formula And Importance

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

コメント

コメントを投稿